- TSX-V: CBITC$0.94

- OTCQB: CBTTF US$0.61

- BTC-USD$90,510.90

Shareholder Letters

2022 Letter to Shareholders

Dear Fellow Shareholders of Cathedra Bitcoin Inc:

In 1798, a British economist was concerned that the incessant increase in population would cause humanity to run out of food. As a solution, he supported a variety of measures aimed at curbing the rate of population growth (e.g., taxes on food) to improve the living standards for those humans who did survive. The economist in question, Thomas Malthus, was raised in a country house in Surrey, was educated at Jesus College Cambridge, became a Fellow of the Royal Society in 1818, and–in simple terms–championed policies designed to limit (or end) human life to prevent this population bomb.

“Instead of recommending cleanliness to the poor, we should encourage contrary habits. In our towns we should make the streets narrower, crowd more people into the houses, and court the return of the plague.”

– Thomas Malthus, “An Essay on the Principle of Population” (1798)

Looking back, we can see that such predictions have (fortunately) not come to fruition. The human population has grown ninefold since Malthus penned his infamous piece, “An Essay on the Principle of Population.” Meanwhile, technology has given humanity the ability to channel energy in ways unimaginable to Malthus, allowing us to enjoy levels of prosperity that make the elitist Malthus look like a serf in comparison. Yet we are not without our troubles.

In response to COVID-19, the last two years have seen an unprecedented degree of government intervention around the world, through mandates as well as record-breaking fiscal and monetary stimulus. Meanwhile, food shortages have visited the developed and developing worlds alike. Housing, asset, and commodity prices are soaring, with even the dubious Consumer Price Index reaching its highest level in four decades in the U.S. And around the world, civil unrest is on the rise.

We believe the root causes of these issues are quite simple: unsound money and unsound energy infrastructure. In this first annual letter to Cathedra Bitcoin shareholders, we examine the current state of both and discuss how they inform our vision for the future of the company.

Macro Update: Energy

The European Energy Crisis

For the last six months, headlines have been filled with a “European Energy Crisis.” As the global economy surged back to life after 18 months of lockdowns, a perfect storm of events unfolded:

- over the summer, China increased natural gas imports following a coal shortage, causing power prices to rise in Europe;

- in September, a wind shortage beset northern Europe, resulting in enormous sums being paid to dispatch other (“dirtier”) forms of generation;

- reduced natural gas imports from Russia left Europe with historically low natural gas reserves;

- in December, unusually cold temperatures hit the continent, sending shockwaves through energy markets (even serving as a catalyst for the civil unrest in Kazakhstan); and

- Russia’s invasion of Ukraine in recent weeks has sent oil and gas prices surging, bringing calls for increased domestic energy production.

These events have conspired to cause a sharp increase in energy prices around the continent. One is tempted to point to any one of the above as a “black swan event” driven by unforeseeable forces beyond our control (in hindsight, it will be even more tempting to blame this crisis on Putin’s invasion of Ukraine). But in reality, Europe has been systematically dismantling its stable energy infrastructure for over a decade. And unfortunately, they are not alone. Take California, for example: over the last decade, the state has seen energy prices rise 7x more than those in the rest of the U.S., and blackouts have become “almost daily events.”

If one looks deeper, a far subtler cause reveals itself: misguided policies that subsidize intermittent renewables and shutter stable forms of generation, the net effects of which are energy insecurity and higher energy costs.

The Real “Energy Transition”

Beginning in the early 2000s, governments around the world began reorienting energy policy around climate change. These “net-zero” policies push for an “energy transition” away from CO2-emitting energy sources toward 100% “renewable” energy, primarily via subsidies to intermittent wind and solar generation.

On the surface, these policies seem to have worked. EU power generation from renewables has increased 157% in the last ten years. As a result, in 2020, renewable generation in Europe surpassed that of fossil fuels for the first time, providing 38% of the region’s electricity (vs. fossil fuels’ 37%). And these policies are only accelerating: in July 2021, the EU announced its even more ambitious goal to reduce greenhouse gas emissions by 55% by 2030, requiring an estimated tripling of wind and solar generation from 547 TWh in 2020 to ~1,500 TWh in 2030.

These pro-renewables policies have been paired with the abandonment of more stable forms of generation. Coal continues to be pushed out of the generation stack due to its heavy carbon footprint and the rising cost of carbon credits. Additionally, despite the seemingly obvious importance of nuclear energy in a “net-zero” carbon future, regulators have been shutting down nuclear reactors around the world in response to environmentalist movements[1] (a trend that accelerated in the wake of the Fukushima disaster). Germany alone shut down 16 GW of nuclear power since 2011, and plans to retire its last three nuclear power plants this year. With hydro being geography-dependent and long-term energy storage unsolved, natural gas is left as the main viable form of dispatchable generation. Given self-imposed fracking bans, Europe has no choice but to import natural gas via LNG or pipelines (largely from Russia).

Returning to California, we see the same dangerous combination of policies. Despite the aforementioned rising electricity costs and grid fragility, the state is decommissioning its last nuclear power plant at Diablo Canyon–responsible for ~10% of the state’s electricity–while reasserting goals to achieve “net-zero” by 2045.

Unfortunately, even if stable forms of generation are not discarded by mandates, renewables subsidies distort market signals. This auxiliary revenue stream of carbon or renewable energy credits allows wind and solar farms to sell power to the grid at negative prices, often driving unsubsidized, baseload generation out of business. The net result? The hollowing out of sound energy infrastructure, which increases both the costs and fragility of the energy system.

In her book Shorting the Grid, Meredith Angwin warns of a “fatal trifecta” affecting grids around the world: (1) overreliance on renewables, (2) overreliance on natural gas, often used to load-follow renewables, and (3) overreliance on energy imports. When demand outpaces supply, either due to diminished output from renewables or heightened demand (e.g., during a cold snap), grid operators seek to dispatch additional generation. But natural gas and energy imports are both vulnerable to disruptions, as natural gas is typically delivered just-in-time via pipelines and neighboring regions are likely to experience correlated supply or demand shocks (read: weather). This results in more expensive energy (increased demand chasing limited supply) or enforced blackouts (e.g., Texas in February 2021).

“Grid fragility” may sound like a highly abstract concept, but its real-world consequences are severe. It means industry halting, hospitals losing power, and even access to clean water being threatened. Such effects are so severe that energy-insecure countries tend to rely on more rudimentary forms of energy, including expensive backup diesel generators, to keep the lights on. Robert Bryce has termed this phenomenon the “Iron Law of Electricity”: people, businesses, and governments will do whatever they must to get the electricity they need[2].

We fear these confused policies are causing an energy transition of the wrong kind–one toward energy insecurity. Its effects are clear in the U.S., where “major electric disturbances and unusual occurrences” on the grid have increased 13x over the last 20 years. Meanwhile, Generac, a leading gas-powered backup generator company, saw 50% growth in sales in 2021 (it's worth highlighting the contradiction between the stated aims of these “net-zero” policies and their downstream effects).

A Malthusian Approach to Energy

Energy insecurity is also expensive. Dependence on intermittent renewables often results in paying top-dollar for energy when it’s needed most. During its September wind shortage, the UK paid GBP 4,000 per MWh to turn on a coal power plant–a clear demonstration that not all megawatt hours are created equal. The quality of energy matters. With renewables, humanity is once again at the mercy of the weather.

This is the underlying logic of these “net-zero” policies: make energy more expensive so that we use less of it. In fact, economists advising the European Central Bank view rising energy costs (“greenflation”) as a feature, not a bug–a necessary consequence of the energy transition.

Rising energy prices are a regressive tax on the least well-off in society. We all require energy to survive (heating/cooling, food, water, etc.), regardless of our wealth. These requirements are effectively a fixed cost; the lower one’s income, the greater the percentage of it one spends on energy. There is a point beyond which rising energy costs become unsustainable, sending people to the streets to fight for their survival–as we saw in Kazakhstan after the spike in LPG prices. Researchers estimate that each 1% increase in heating prices causes a 0.06% increase in winter-related deaths, with disproportionate effects in low-income areas.

“If energy is life, then the lack of energy is death.”

– Doomberg, “Shooting Oil in a Barrel” (2021)

Energy is the key input for every other good and service in the economy, and over time accounts for all wealth in an economy. To the extent energy gets more expensive, so does everything else (including and especially food), making society poorer. This is the Malthusian approach to energy. Expensive “green” energy that the elites can afford, while the unwashed masses bear the brunt of those rising costs. Energy for me, but not for thee. We question the political and social sustainability of such an approach.

Enter Entropy

Energy’s role is even more fundamental to the economy and human well-being than most understand. As we’ve discussed elsewhere, what is commonly understood as “energy generation” is really just the conversion of energy into a more highly ordered form; it is the reduction of entropy locally by shedding even greater amounts of entropy elsewhere. Despite the universality of this entropy reduction, some energy resources are inherently lower-entropy than others (highly dense nuclear fission vs. low-density wind power). We depend on this entropy reduction to sustain us through the food and energy we need to maintain the order of civilization.

This entropy reduction is cumulative; without sufficient entropy-reducing energy infrastructure, we cannot maintain our existing order. We cannot create entropy-reducing energy infrastructure without adequate pre-existing infrastructure. And we cannot advance further as a civilization (i.e., create more order) unless we develop even more entropy-reducing infrastructure.

“We never escape from the need for energy. Whatever the short-term variations might look like, the trend over time is for greater energy use, to deliver and crucially to maintain and replace a human sphere that is progressively further away from thermodynamic equilibrium. There is no point at which you sit down and have a rest.”

– John Constable, “Energy, Entropy and the Theory of Wealth” (2016)

There is no free lunch when it comes to energy. If a country’s economy grows while reducing energy consumption, it is only through de-industrialization, exporting its energy footprint to other countries (the same often holds true for carbon emissions). The second law of thermodynamics is indeed a law, the best attested regularity in natural science, not a tentative suggestion: the entropy must go somewhere.

Unfortunately, distortions caused by our current monetary system have convinced many otherwise, a deception that has had dire consequences.

Macro Update: Money

For the last 50 years the world has participated in an unprecedented experiment: a global fiat monetary standard. In 1974, a few years after “Tricky Dick” Nixon rug-pulled the other governments of the world by severing convertibility of the U.S. dollar into gold, the U.S. struck a deal with Saudi Arabia to cement the dollar’s status as the global reserve currency: the OPEC nations would agree to sell oil exclusively for U.S. dollars, and the Saudis would receive the protection of the U.S. military in return. This arrangement, which survives to this day, became known as the “Petrodollar system,” and it has had enduring economic, social, and political consequences:

- securing the dollar’s status as the reserve currency of the world;

- bidding up U.S. asset prices via petrodollar “recycling;”

- displacing U.S. manufacturing capabilities and increasing economic inequality between American wage-earners and asset-owners; and

- contributing to the secular decline in interest rates, causing an accumulation of public- and private-sector debts and distortions in the pricing mechanism for all other assets (typically viewed in relation to the “risk-free rate” of interest on Treasuries).

In recent years, cracks in the foundation of this system have begun to show. A half-century of irresponsible fiscal and monetary policy has pushed sovereign and private sector debt to the brink of unsustainability and fragilized financial markets. The once steady foreign demand for Treasuries is evaporating, forcing the Fed to begin monetizing U.S. deficits at an increasing rate. The U.S.’s share of global GDP is waning, and the role of the dollar in key trading relationships is diminishing. Even the once-mighty U.S. military—on whose supremacy the entire Petrodollar system was predicated—shows signs of degeneration.

The U.S. response to the COVID-19 pandemic has accelerated many of these trends. Through a series of legislative and executive actions in 2020 and 2021, Congress and the Trump and Biden administrations approved nearly $7 trillion of spending on COVID relief, a large majority of which increased the federal deficit. Not to be outdone, the Fed authorized its own emergency measures to the tune of $7 trillion.

In the nearly two years since these extraordinary actions, the U.S. and the global economy has been defined by record-low interest rates (which is part of the explanation for the interest in subsidized renewables); acute supply chain disruptions (read: shortages) across critical markets; a continuation of the asset price inflation of prior decades; and the highest levels of consumer price inflation in 40 years. This last development—“not-so-transitory” CPI inflation—is perhaps most significant given it represents a departure from economic conditions since the Great Financial Crisis.

The Fed now faces a predicament. With mounting cries from the public and political officials over the runaway CPI, the pressure is on Jay Powell & Co. to arrest inflation by raising interest rates. But the current state of public and private sector balance sheets complicates matters. As the Fed increases rates, so too does it increase the federal government’s borrowing cost, not to mention that of a private sector which is also saddled with dollar-denominated debt. If corporates are unable to service or refinance their debt, they will be forced to reduce costs, resulting in higher unemployment. Rest assured; rates aren’t going higher for long. Global balance sheets will not allow it.

This suggests to us that we may be entering a period of financial repression, whereby inflation is allowed to run hot while interest rates remain pinned near zero, producing negative real returns and deleveraging balance sheets over several years. We also find it likely that the Fed will be forced to implement some version of a yield curve control program. Under such a policy, the central bank commits to purchasing as many bonds as necessary to cap the yields of various maturities of Treasuries at certain predetermined levels. There is precedent for a maneuver of this sort: the Fed implemented a version of the policy throughout the 1940s to inflate away the national debt during and after WWII.

At the end of the long-term debt cycle, the only option is to inflate away the debt and debase the currency. But unlike in the 1940s, citizens, businesses, and governments now have several monetary alternatives available to them. We therefore believe the coming period of structural inflation will hasten a transition to a new monetary standard.

The Currency Wars Cometh

The writing is on the wall; the post-Bretton Woods monetary system is in its death throes. The question is not if we will see a paradigm shift away from the present dollar-based monetary order, but when. And the far more interesting question, in our view, is: what will replace it?

We believe the next global monetary system will be built atop Bitcoin—with bitcoin the asset and Bitcoin the network working together to offer final settlement in a digitally native, fixed-supply reserve currency on politically neutral rails. Bitcoin uniquely enables this value proposition, and game theory and economic incentives will compel nation-states to take notice amid the collapsing monetary order. But it is not without competition.

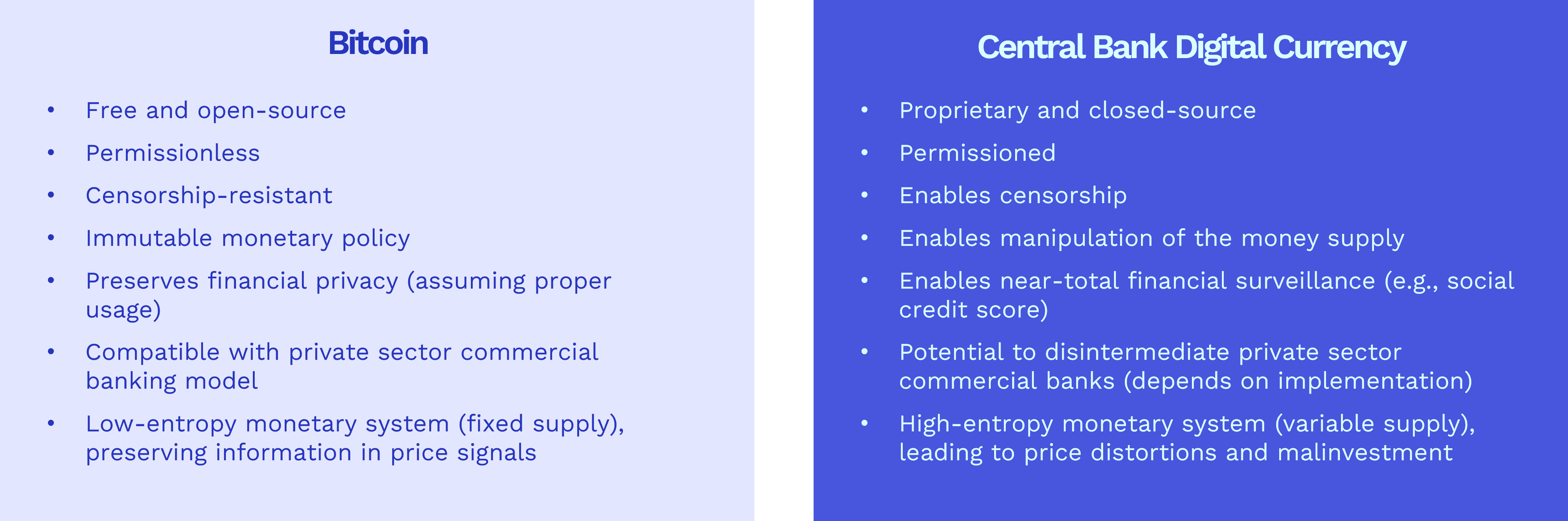

Central Bank Digital Currencies

Bitcoin is the ideological and economic foil to another candidate for heir to the petrodollar: the central bank digital currency (“CBDC”). The retail CBDC—which is the variety most often discussed in policy circles—is a natively digital form of fiat money that is issued, managed, and controlled by the central bank. Their proponents claim CBDCs would enable many of the same benefits as cryptocurrencies—near-instant final settlement, programmability, high availability, etc.—without many of the attendant “disadvantages”—decentralization, untraceability, etc.

CBDCs open up a whole new design space for monetary authorities, empowering them to implement creative and fine-grained policies which heretofore have been confined to masturbatory thought-experiments in BIS papers (e.g., negative interest rates). They would also allow for all manner of fiscal policies which today are operationally or technically infeasible; one can imagine government-imposed parameters around how and when a given sum of CBDC money is spent, digitally programmed into one’s Fed wallet. A universal basic income program could be effected with a single keystroke.

In many ways, the CBDC is the perfect Malthusian implement. Their inherent programmability allows for granular, top-down rationing of resources for whatever “greater good” suits the politically powerful. “I’m sorry, sir. Your card has been declined, as you have already exceeded your weekly beef quota. Might we suggest a more environmentally friendly alternative, such as a Bill Gates pea protein patty?” Such a system amounts to highly efficient regulatory capture; citizens are only permitted to spend money on those goods and services favored by The Powers That Be (or the corporate interests that fund them). Expect CBDCs to further distort the pricing mechanism, leading to a variety of market failures (such as the current energy crises). Skeptics of such claims need only be reminded of the U.S. government’s recent history of abusing its power to restrict politically undesirable financial activities.

It should come as no surprise that the CBDC model is being pioneered by the Chinese Communist Party in the form of a “digital renminbi.” Make no mistake—wherever a CBDC is implemented, it will be weaponized by the State for political ends. In the West, such a system would be readily abused to create a Chinese-style social credit system—but one cloaked in the neo-liberal parlance of “financial inclusion,” “climate justice,” and “anti-money laundering.”

CBDCs: Coming to A Country Near You?

We remain cautiously optimistic that the U.S. will forgo implementing this dystopian technology. The U.S. remains among the freest nations in the world, both politically and culturally. A CBDC is wholly incompatible with American values, and we expect millions of Americans would resist the complete usurpation of their financial lives by the State. Additionally, a retail CBDC implemented by the Fed would transfer power from the commercial banks whose interests the Fed was conceived to protect to the federal bureaucracy[3]. And is there any doubt that the U.S. now lacks the state capacity to implement a CBDC, a feat which would require a high degree of technical and operational competence?

Figure 1: Which Way, Western Man? BTC vs. CBDC

Bitcoin for America

So, how can the U.S. extend its financial leadership of the 20th century amid the decaying Petrodollar system? The U.S. is already the frontrunner in nearly all things Bitcoin—trading volumes, mining activity, number of hodlers, entrepreneurial and business activity, capital markets activity, etc. We submit that the path of least resistance would be for America to lean into its leadership in the Bitcoin industry and embrace the technology as a privacy-respecting, open-source, free-market, and fundamentally American alternative to the totalitarian CBDC.

What does “adopting Bitcoin” look like for a country like the U.S.? It is likely some combination of: (i) authorizing bitcoin as legal tender, (ii) removing onerous capital gains tax treatment, (iii) subsidizing or sponsoring mining operations (which could support domestic energy infrastructure, in turn), (iv) purchasing bitcoin as a reserve asset by the Fed and/or Treasury, or (v) making the dollar convertible into bitcoin at a fixed exchange rate.

We see early signs that such a move by the U.S. may not be so far-fetched. Notably, major American policymakers have already signaled support for bitcoin as an important monetary asset and nascent industry. The “crypto” sector has grown into an important lobby in D.C. and represents a highly engaged, motivated constituency—politicians are taking notice.

In our estimation, Bitcoin’s economic incentives and congruence with American values make it the leading candidate for U.S. adoption as a successor to the present monetary order. As the current dollar-based system continues to deteriorate, we are excited by the potential for a U.S.-led coalition of freedom loving nations moving to a Bitcoin Standard.

Money, Energy, and Entropy

Energy is the fundamental means to reduce entropy in the human sphere, and money is our tool for the direction of energy towards this end. We use money to communicate information about economic production, resolving uncertainty about how scarce resources ought to be employed. And we seek out highly ordered sources of energy to resist the influence of entropy on our bodies and societies.

In his lecture, “Energy, Entropy and the Theory of Wealth,” John Constable of the Renewable Energy Foundation observes that all goods and services—and indeed, civilizations—are alike in that they are thermodynamically improbable. All require energy as an input and necessarily create order (i.e., reduce entropy) in the human domain, shifting the local state further away from thermodynamic equilibrium.

So then, wealth can be understood as a thermodynamically improbable state made possible through human entropy reduction. If material wealth is measured by the goods and services one has at one’s disposal, then wealth creation on a sound monetary standard is the reduction of entropy for others, and one’s wealth is a record of one’s ability to reduce entropy for fellow man.

Unsound money (of the sort the Malthusians celebrate) increases uncertainty—and therefore, entropy—in economic systems. Active management of the money supply confuses the price signal, reducing the information contained therein and erecting an economic Tower of Babel. Fiat money therefore contributes to malinvestment—entrepreneurial miscalculations which produce the wrong goods and services and increase societal entropy.

Nowhere is this more apparent than in our energy infrastructure: unsound money has caused malinvestment in unsound sources of generation. As noted above, a half-century of government subsidies and declining interest rates made possible by the Petrodollar system has steered capital towards unreliable renewables that invite greater entropy into the fragile human sphere, dragging us ever closer toward thermodynamic equilibrium (read: civilizational collapse).

Cathedra Bitcoin Update

Our macro views on energy and money inform everything we’re doing at Cathedra. Chief among them is the belief that sound money and cheap, abundant, highly ordered energy are the fundamental ingredients to human flourishing. Our company mission is to bring both to humanity, and so lead mankind into a new Renaissance—one led by Bitcoin and the energy revolution we believe it will galvanize. Accordingly, with Cathedra we’ve set out to build a category-defining company at the intersection of bitcoin mining and energy. One which is designed to thrive in the turbulent years of the present energy and monetary transition and in the hyperbitcoinized world we believe is to come.

In December we announced a change of the company’s name from Fortress Technologies to Cathedra Bitcoin. Our new name reflects our aspirations for the company and for Bitcoin more broadly. The gothic cathedral is a symbol of bold, ambitious, long-term projects; indeed, any single contributor to the monument would likely die before its completion, but contributed nonetheless—because it was a project worth undertaking. So it is with Cathedra, and so it is with Bitcoin.

The religious connotations of the name “Cathedra” are not lost on us. Rather, they’re an indication of the seriousness with which we regard this mission. Ours is a quest of civilizational importance.

Our new name also hints at another distinguishing feature of our business: we focus our efforts on Bitcoin, and Bitcoin only. The difference between Bitcoin and other “crypto” networks is one of kind, not degree. Bitcoin is the only meaningfully decentralized network in the “crypto” space, which is why bitcoin the asset will continue to win adoption as the preferred form of digitally native money by the world’s eight billion inhabitants. Bitcoin seeks to destroy the institution of seigniorage once and for all. Your favorite shitcoin creator just wants to capture the seigniorage himself.

We feel strongly that our long-term mission of delivering sound money and cheap, abundant energy to humanity can be best achieved through a vertically integrated model. In the long-term, Cathedra will develop and/or acquire a portfolio of energy generation assets that leverages the synergies between energy production and bitcoin mining to the advantage of both businesses. In a decade, Cathedra may be as much an energy company as a bitcoin miner.

Vertical integration will allow us to control our supply chain and rate of expansion to a greater degree, in addition to giving us a cost advantage over our competitors. As a low-cost producer of bitcoin, we will also be positioned to deliver a suite of ancillary products and services to customers in the Bitcoin and energy sectors.

And we’ve begun making strides toward this goal. Earlier this year, the Cathedra team expanded by three with the hires of Isaac Fithian (Chief Field Operations and Manufacturing Officer), Rete Browning (Chief Technology Officer), and Tom Masiero (Head of Business Development). Each of these gentlemen brings years of experience in developing and deploying mobile bitcoin mining infrastructure in off-grid environments. With this expanded team, we recently began production of proprietary modular datacenters to house the 5,100 bitcoin mining machines we have scheduled for delivery throughout 2022. We’re calling these datacenters “rovers,” a nod to their mobility, embedded automation, and capacity to operate under harsh environmental conditions in remote geographies. The modularity and modest footprint of our rovers will allow us to produce them at a rapid pace and deploy them wherever the cheapest power is found, in both on- and off-grid environments. We are proud to be manufacturing our fleet of rovers entirely in New Hampshire, working with the local business community to bring heavy industry back to the U.S.

As bitcoin miners, we view ourselves as managers of a portfolio of hash rate. As in the traditional asset management business, diversification can be a powerful asset. Whereas most of the large, publicly traded bitcoin miners are pursuing a similar strategy to one another—developing and/or renting space at hyperscale, on-grid datacenters in which to operate their mining machines—we have optimized our approach to minimize regulatory, market, environmental, or other idiosyncratic risk within our portfolio of hash rate. If one has 90% of one’s hash rate portfolio concentrated in a single on-grid site, 90% of one’s revenue can be shut off by a grid failure or other catastrophic event—an occurrence which is sadly becoming more common, as highlighted in our Energy Update. To our knowledge, Cathedra is the only publicly traded bitcoin miner with both on- and off-grid operations today.

We increasingly believe that the future of bitcoin mining is off-grid. On-grid deployments are already vulnerable to myriad unique risks today, and we believe their economic proposition will become less attractive over time. As power producers continue to integrate bitcoin mining at the site of generation themselves, large on-grid miners positioned “downstream” in the energy value chain will see their electricity rates rise. Today, “off-grid” describes any arrangement in which a bitcoin miner procures power directly from an energy producer. Popular implementations include stranded and flared natural gas and behind-the-meter hydro and nuclear. In the long-term, we believe the only way to remain competitive will be to vertically integrate down to the energy generation asset.

Mining bitcoin is a capital-intensive business. To ensure we have access to the capital we’ll require to execute on our vision, we’ve embarked on several capital markets initiatives. In February, Cathedra commenced trading on the OTCQX Best Market under the symbol “CBTTF.” This milestone represents a significant upgrade from our prior listing on the OTC Pink Market and should enhance our stock’s accessibility and liquidity for U.S. investors. We intend to list on a U.S. stock exchange in 2022 to further increase the visibility, liquidity, and trading volume in our stock.

We recently announced that Cathedra secured US$17m in debt financing from NYDIG, a loan secured by bitcoin mining equipment. When it comes to borrowing in fiat to finance assets that produce bitcoin—an asset which appreciates 150%+ per year on average—almost any cost of debt makes sense. We intend to continue using non-dilutive financing in a responsible manner where possible, with a sober appreciation for the risks debt service presents as an additional fixed cost.

Accumulating a formidable war chest of bitcoin on our corporate balance sheet is a priority for us. If one believes, as we do, that the next global monetary order will be built with Bitcoin at its center, then those companies with the largest bitcoin treasuries will thrive. We will continue to hold as much of our mined bitcoin as possible and may even supplement our mining activities with opportunistic bitcoin purchases on occasion.

At time of writing, Cathedra has 187 PH/s of hash rate active, and another 534 PH/s of hash rate contracted via purchases of mining machines we expect to be delivered from April through December of this year. Since we replaced the prior management team in September, we have grown Cathedra’s contracted hash rate by more than 300%. And we’re just getting started.

Conclusion

We stand today at a crossroads between two divergent movements defined by conflicting visions for the future: Malthusianism and Prometheanism.

The Malthusians believe progress is zero (or even negative) sum; resources are finite and “degrowth” is the only viable path forward; we ought to judge human action first and foremost by whether it disturbs the natural world. This movement is characterized by totalitarian CBDCs and a desire to make energy more scarce and expensive, so that earth’s resources can be appropriately rationed.

On the other hand, the Prometheans carry with them a more optimistic vision: progress is positive-sum; human creativity allows us to liberate and employ resources in novel ways, in turn preserving the natural world for our own benefit; and that human flourishing is the moral standard by which we should evaluate human action.

These are social, cultural, and spiritual choices we are all called to confront.

“The century will be fought between Malthusians (“resources are finite”; obsessed with overpopulation; scarcity mindset; zero-sum, finite games) and Prometheans (“human imagination is the most valuable natural resource”; abundance mindset; positive sum, infinite games).”

– Alpha Barry (2020)

The Malthusian camp wants top-down, centralized management of resources via CBDCs and energy rationing policies. They believe our energy resources are fixed; the only path forward is backward, farming for energy using huge swaths of land controlled by the privileged few. “Industrialization for me but not for thee.” “You’ll own nothing and be happy.” These are the slogans of the Malthusian movement.

This is not the path that took us to space and lifted billions out of poverty. We, Cathedra, choose the other path. That of Prometheus, who stole fire from the gods to benefit humankind.

We believe in a future of sound money that brings property rights to eight billion humans around the world. A world of beautiful, free cities powered by dense and highly ordered forms of energy generation. Small modular nuclear reactors with load-balancing bitcoin miners (and no seed oils). A future in which technology is employed to improve the human condition–not only for those who walk the earth today, but for generations to come.

Bitcoin mining is a powerful ally to the Promethean cause. As the energy buyer of last resort, Bitcoin promotes sound money and sound energy infrastructure. No two forces are more fundamental to keeping disorder at bay and advancing human civilization.

We at Cathedra are not alone; there are other Prometheans working tirelessly to further this vision of a freer, more prosperous tomorrow. Human flourishing is earned, not given. Together, we win.

Drew Armstrong

President & Chief Operating Officer

AJ Scalia

Chief Executive Officer

7 March 2022

Block height: 726,355

Our sincere thanks to Marty Bent, John Constable, Thomas Pacchia, and Roy Sebag for reviewing and providing feedback on drafts of this letter.

1 If the goal is truly to preserve the environment, then policymakers should champion reliable, energy-dense fuels that minimize the required amount of land per unit of energy produced, thereby preserving local ecosystems and biodiversity.

2 For example, despite aggressive sanctions and anti-Russia rhetoric in the west, many western countries are still importing Russian oil and gas (and energy payments have been explicitly excluded from economic sanctions against Russia).

3 G. Edward Griffin’s The Creature from Jekyll Island offers a fascinating account of the founding of the Federal Reserve system for the more conspiratorially-minded shareholder.